Ali Express Sales Tax

I called several places that would know in my statethe answer was that Aliexpress IS lying. This applies to orders valued at AUD1000 or under for product categories such as books jeweler electronic devices sports equipment cosmetics and clothing.

At Aliexpress We Will Pay Vat Directly Information About The New Rules

In my experience when I have ordered from China I have not been charged sales tax.

Ali express sales tax. Online sellers are obligated to collect sales tax in states where they have a nexus. There seem to be no way to effectively communicate with them as all their emails come from a no-reply address and their live chat is anything but and totally useless. Sales taxes is when a governing body places a tax on goods or services sold within their jurisdiction.

Also this is the first notification I have received regarding this New Internet Sales Tax and I sell on the big 3 online sales platforms. US 001 US 450. Total amount Sum of delivering orders The amount of received orders for current month.

Check out all the deals. It is a bummer and unless the price including tax and free shipping is too good to pass up Ill be altering my purchasing habits in the future. There is a recent Supreme Court ruling that requires ALL internet sales to charge sales tax.

In AliExpress you can also find other good deals on fitness and body building sports and entertainment and computer and office. One if the value of the package is above 15 you will have to pay VAT. K Kiki wong Oct 19 2019.

US 001 US 499. Any package will need import clearing and VAT to be paid. There are two things to keep in mind for AliExpress import duty for the UK.

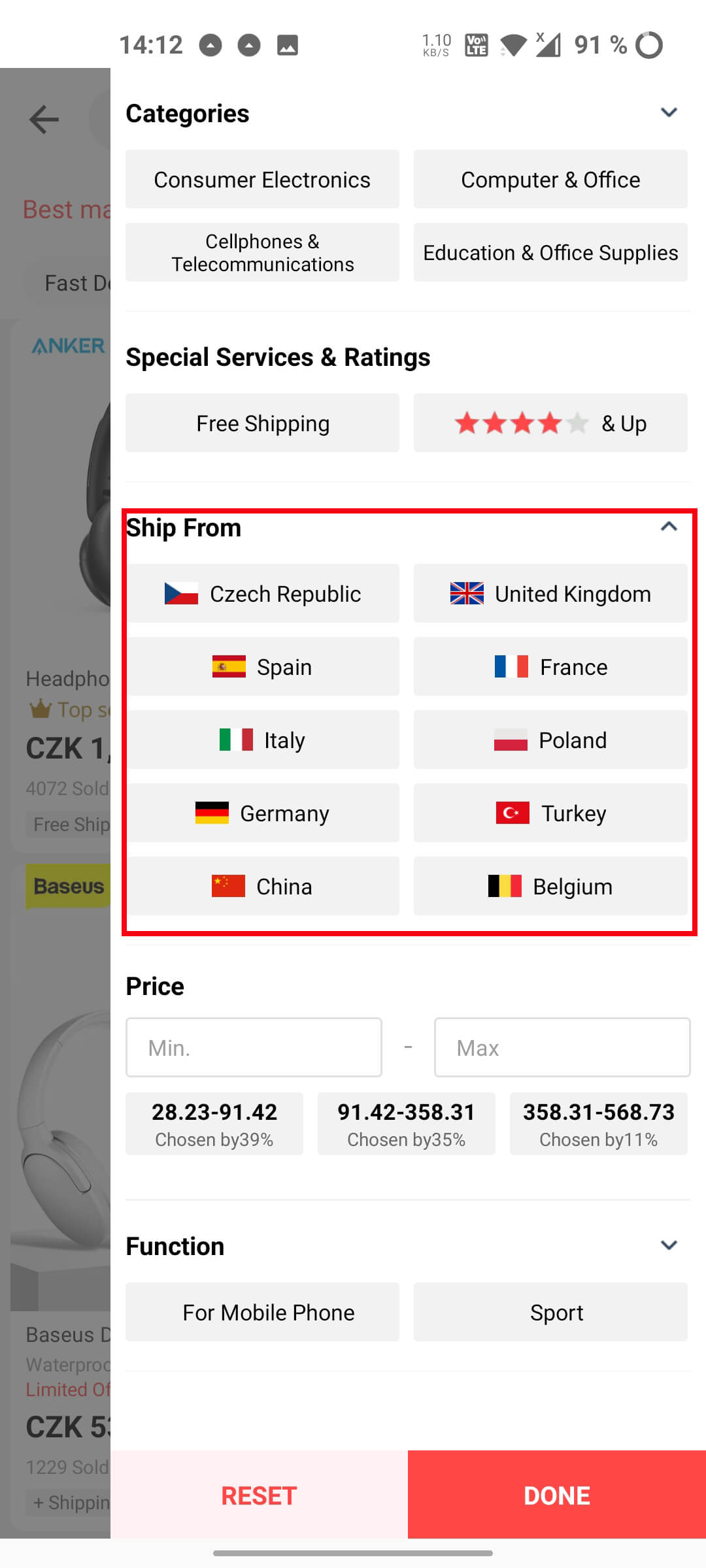

Spain 21 France 20 Poland 23 Belgium 21 Italy 22 Germany 19 Netherlands 21. The tracking reports from both Aliexpress and Philpost said Import authorised. No taxes or duties to be paid According to the tracking history this assessment was.

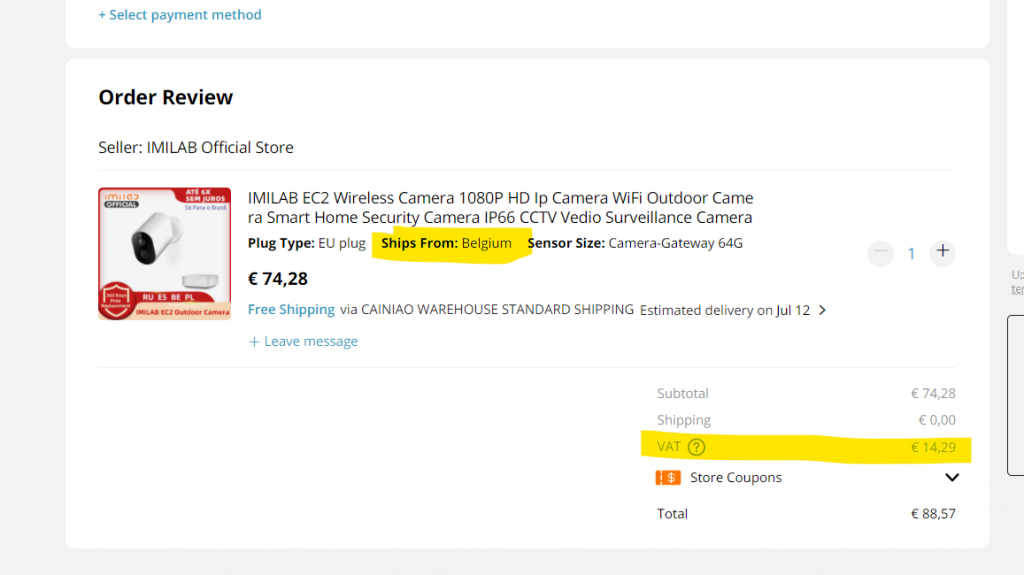

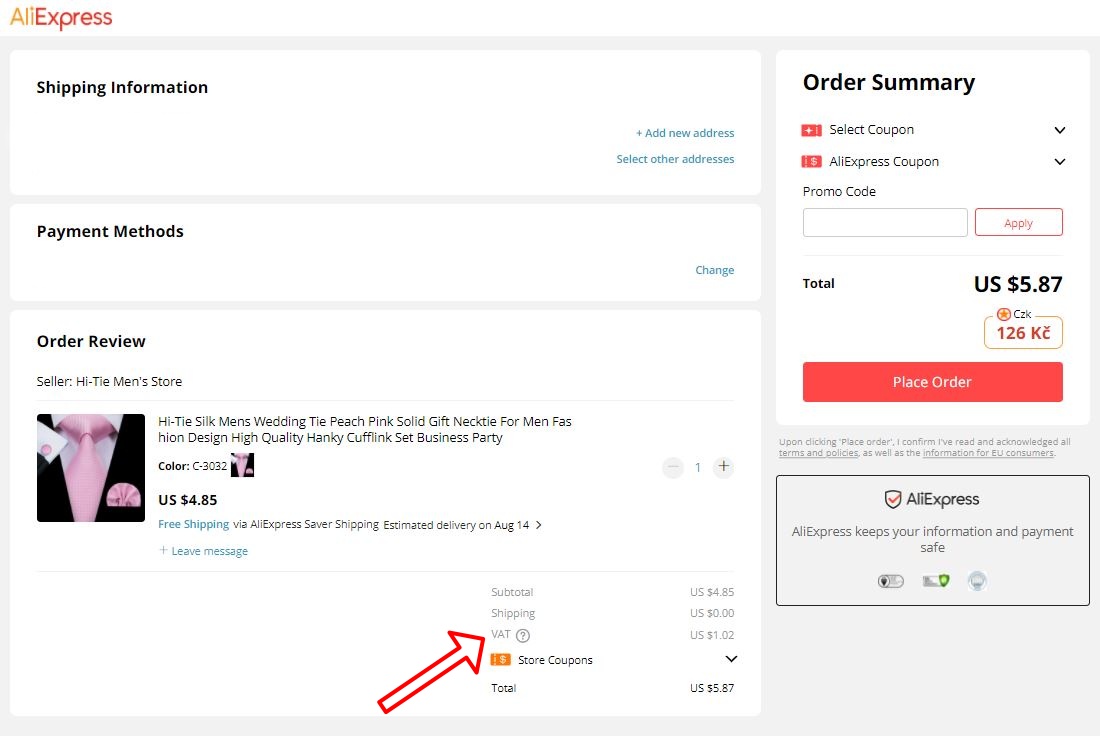

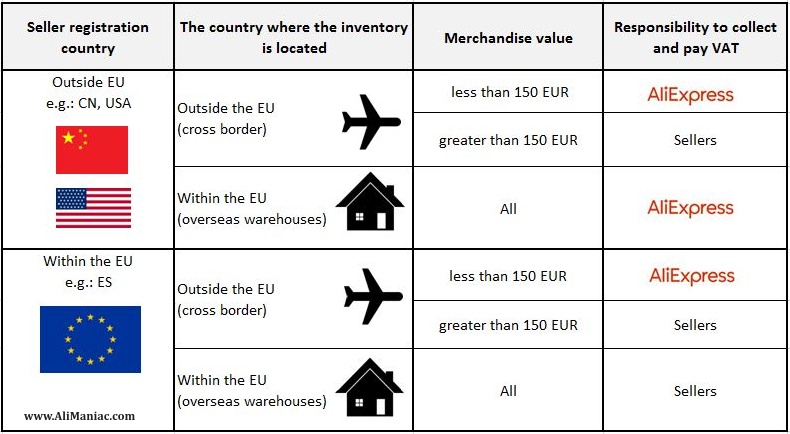

2 pin Horn Switch Button large size for Scooter Moped Go Kart. Beliebte Heiße Suche Ranking-schlüssel wörter-Trends in 2021 in Kraftfahrzeuge und Motorräder Sport und Unterhaltung Werkzeug Computer und Büro mit tax sales und Heiße Suche Ranking-schlüssel wörter. 2 AliExpress will calculate and pay VAT in some cases.

Button to check your Aliexpress spending per each delivery address. A good rule of thumb is an added 20 of. Help Center - AliExpress.

Dont exceed your country customs duty-free limit Dont exceed your country customs duty-free limit The extension shows information about orders for each address calculated by the formula. I have sent message to sellers and they responded that they did not charge or receive the tax amount that I have been charged. You can shop for sales tax free at low prices.

On my recent purchases I was charged the sales tax. Shop Online247 Help Center. Theoretically an import tariff can be charged and I was charged a tariff a few times but that is a separate issue.

October 06 2019 063640 pm Its not about taxing eBay and AliExpress but about taxing users of eBay and AliExpress and specifically forcing the platforms to collect the tax as they are large entities easier to pressure and intimidate than millions of individuals who dont give a fuck. With low prices we dont fault you for shopping hot sale online all the time. Hi Mark here from KeepShoppers You should only charge sales tax if you are obligated to collect it in a certain state and you must get a sales tax license in that state to be able to collect sales tax.

Aliexpress collects sales tax from buyer and then transfer it to Tax. For example District of Columbia requires the out-of-state seller to register for a DC sales tax permit in order to issue a resale cert to the drop shipper AliExpress in order for AliExpress to not charge you the sales tax. However the VAT rate is dependent on the package content for AliExpress baby clothing has a VAT rate of 0 for example.

Having a nexus means that a seller has a presence in that state - a home or an office a warehouse. Goods imported from AliExpress are now subject to sales taxes. In the US it is individual states that can set their own tax rate.

Discover more Double 11 festival huawei m6 Black Friday ryzen 5 3500x chuwi book baofeng uv 82 xiaomi redmi note 8 ssd disk samsung a51 agm x3 mechanical keyboard xiaomi redmi 8 pro iphone 8 iphone 7 anne pro samsung galaxy s10 poe switch nokia 208. Ad Promotions on clothing electronics sports and more. I just got an email from eBay explaining that 11 new states have adopted Internet Sales Tax Policy as of today October 1st.

AliExpress is charging us sales tax even though we have our 501c3 charity bike shop listed with PayPal and have sent them their exemption form and a copy of our state Florida exemption certificate. The previous poster is correct the seller is never aware of the tax. I was already paying sales tax on items purchased on eBay in Colorado so I am wondering why Aliexpress is just now collecting sales tax.

Aliexpress is charging their customers for US taxes this IS illegal contact the Federal Trade Comissionso far they are the Only site doing this and the FTC needs people to open cases against themAliexpress will tell you that they are commissioned by our states to collect the taxit is not true. 21 tooth Kick Starter Shaft 74mm 292 inch. Standard rates range from 17 Luxembourg to 27 Hungary.

Answer 1 of 15. For some states in USA and some other countries sales tax is imposed for online purchase. Of course then you will have the responsibility of collecting and remitting DC sales tax on all sales shipped into DC.

Imported goods in Australia are charged a 10 GST on the price of products. I made a purchase from aliexpress about a month ago and I just picked up one of my parcels from the post office. No it never indicates youll be charged tax until you click to buy.

What is sales tax do I need to pay for aliexpress dropshipping and shopify dropshipping. Aliexpress and ebay are now collecting sales tax Reply 19 on. I started to see it on every purchase I made around Nov.

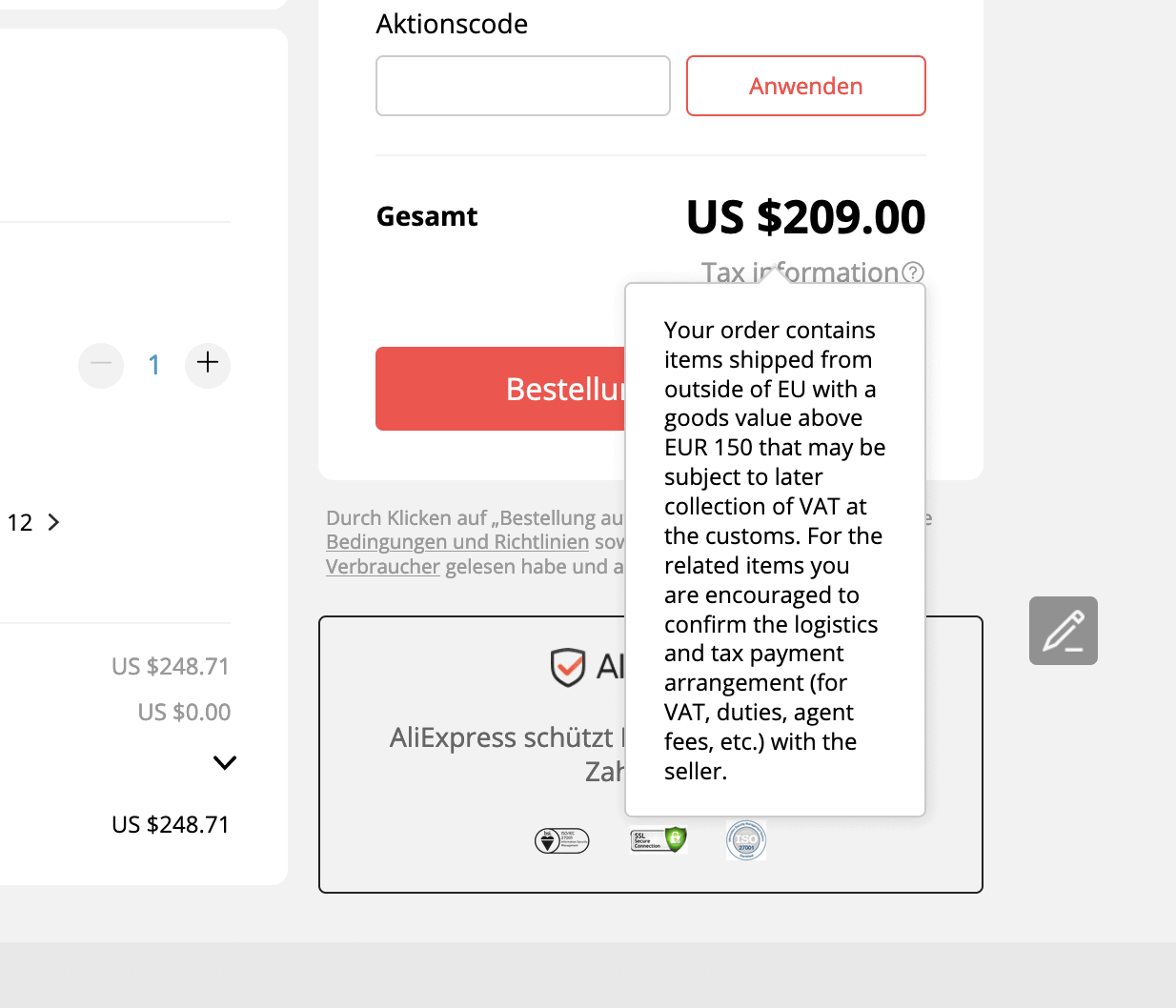

As far as Im aware after January 1 2021 the EU abolishes the VAT-free limit for packages below 22. AliExpress Import Tax for the UK. So that means it.

Details about tax VAT after January 1 2021 for UK buyers. The VAT rates of AliExpress in key EU countries can be referred to as follows. Aliexpress collects sales tax from buyer and then transfer it to Tax.

- Ship from Free Shipping Up. To keep up to date with local authority laws check out our AliExpress sales taxes guide. US 001 US 339.

AliExpress Import Tax in Australia. The old rule was that sales tax was applied only if the seller had a physical presence in the State. Everything before that was none taxed.

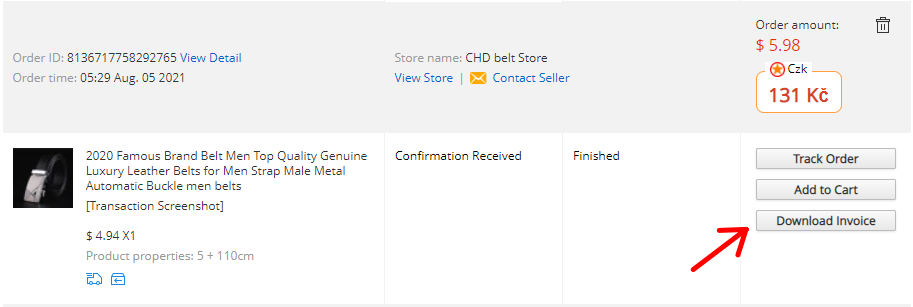

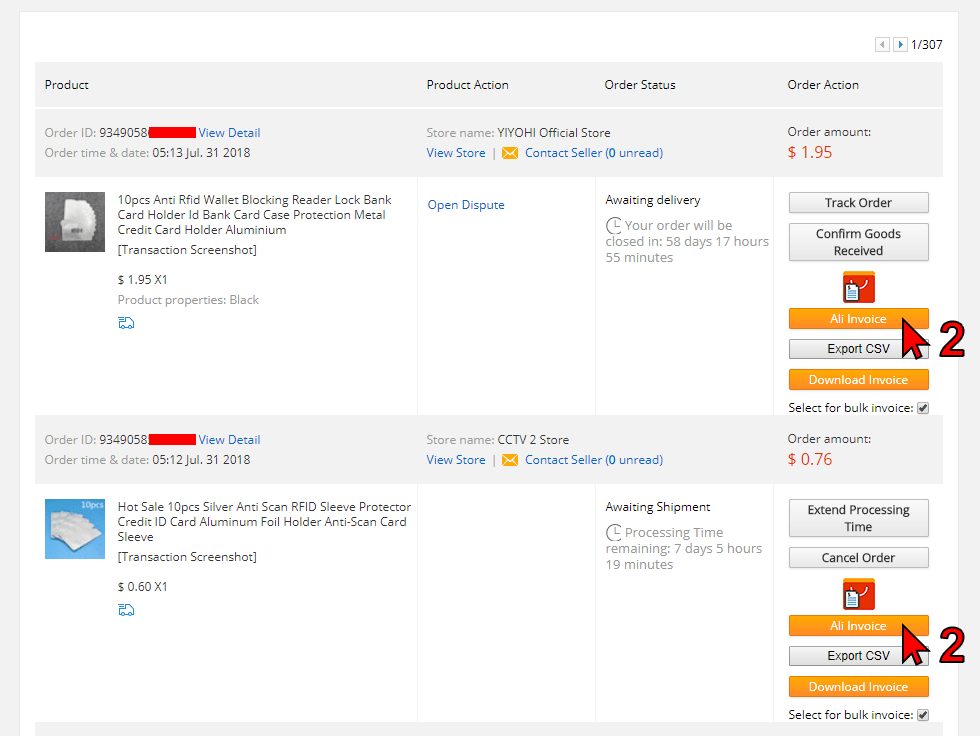

Solved How To Generate Aliexpress Invoices For Tax Purposes Shopify Community

Aliexpress Import Taxes And Customs Guiding Light For Usa Buyers Alitools Io

55 How Do I Get An Invoice For Goods From Aliexpress

At Aliexpress We Will Pay Vat Directly Information About The New Rules

Aliexpress Will Automatically Collect Vat From 1 7 Thanks To Ioss Registration

Aliexpress Will Automatically Collect Vat From 1 7 Thanks To Ioss Registration

At Aliexpress We Will Pay Vat Directly Information About The New Rules

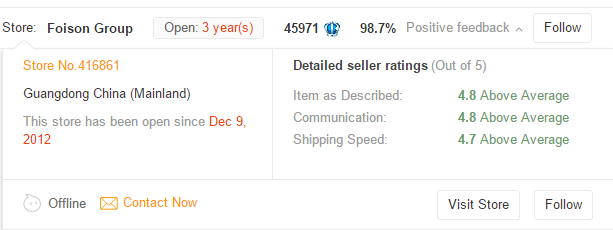

How To Buy Wholesale From Aliexpress Guide 2021

How To Get An Invoice From Aliexpress Megabonus

At Aliexpress We Will Pay Vat Directly Information About The New Rules

Sheet Now Norwegians Has To Pay Tax Or Is This For Everyone At Least It Ll Be Less Purchases Through Norway R Aliexpress

Aliexpress Und Die Umsatzsteuer Wie Lauft Das Aktuell Keine Angst Vor Bestellungen Aus China Techtest

![]()

New Eu Tax Regulation From July 1 2021 R Aliexpress

How To Get An Invoice From Aliexpress Megabonus

Things To Remember While Purchasing From Aliexpress

Solved How To Generate Aliexpress Invoices For Tax Purposes Shopify Community

How To Search Aliexpress In European Warehouses China Planet

Posting Komentar untuk "Ali Express Sales Tax"