Ali Express Us Trade Tarifs Tax Duty

This value includes the price paid for goods postage packaging and insurance. By providing our team of brokers with several pieces of key information we can determine the rates due and assist you in clearing the products.

If You Want To Predict Your Costs In Advance When Importing To The Uk You Ll Need A Commodity Code To Work Out Your Uk Duty Coding Finding Yourself Trading

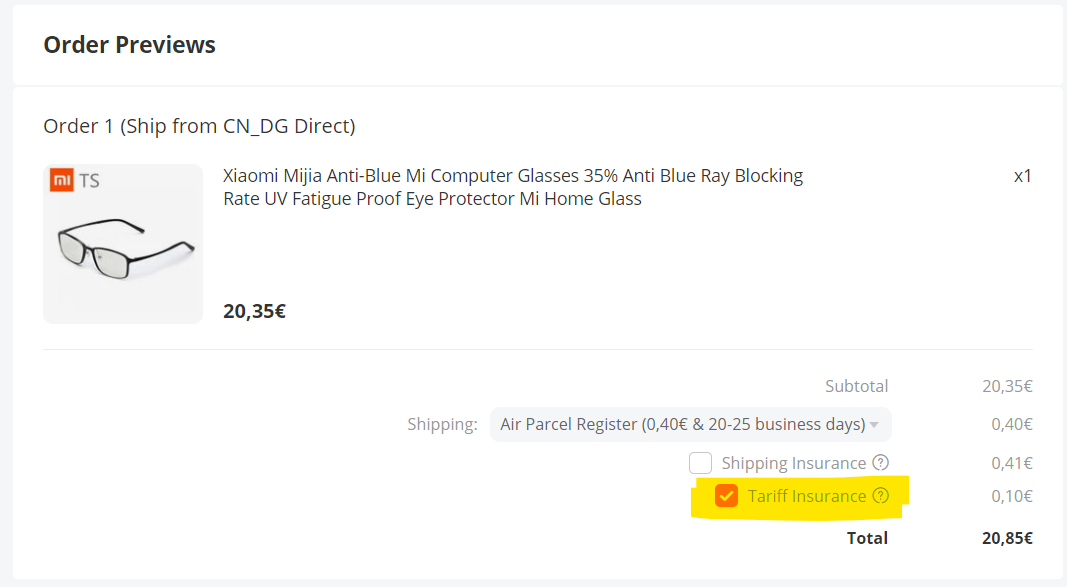

When a trade agreement is in place between those countries tariffs are.

Ali express us trade tarifs tax duty. Currently there is no end in sight to the US-China trade war. LED LED bulb LED lamps and LED lights have different tariff rates. Tariffs are a form of regulation of foreign trade and a policy that taxes foreign products to encourage or safeguard domestic industry.

Most of the time a tariff is an ad valorem tariff percentage of value or a specific tariff eg. To find out how much youll need to pay youll need to check the commodity code for umbrellas and apply the import duty rate for that code 65. So basically as long as youre staying under 800 value for.

The de minimis rule allows imports of less than 800 a day per person entered dutytax free. Look up commodity codes duty and VAT rates. Different tariffs applied on different products by different countries.

Cheap Rowing Boats Buy Quality Sports Entertainment Directly from China SuppliersChina customs duty tax Import tariff customs duties import tariffs. This is over Rs30000 at the current exchange rate may attract a duty of 40 with taxes included. National sales and local taxes and in some instances customs fees are often charged in addition to the tariff.

The US. 20 percent or SAR 100 USD0267 per kilogram whichever is higher. The situations for AliExpress import duty for the USA have been changing the last few years depending on the president.

Finally and very generally most duty rates fall between 2 and 30. Goodadas USA customs import and export duty calculator will help you identify the export tariff rates you will pay for the USA. The second reduced VAT rate of 10 percent came into force on January 1 2015 and applies mainly to baby food medicines and books.

Import duty on cloths from China to US. Less often it can be a compound tariff made up of both of these elements applies. Buy Direct from China Suppliers.

Tax will be due on the cost of the goods without shipping which in this case is 28000. Ad Great Deals on Millions of Products. A 10 to 25 duty rate is likely to become the new normal.

A tariff is a customs duty or tax levied on imports of merchandise goods. US imports from China not only electronic items they also import cloths and other items. Please be aware that the duty rate you request is only as good as the information you provide.

Ad 10 Years of Experience - Hassle-Fee Tax Prep - Lowest Prices - Highly Rated. Customs value customs duty rate MPF fee. A tariff or duty the words are used interchangeably is a tax levied by governments on the value including freight and insurance of imported products.

The import duty from China to US is imposed according to the tariff rate. President Trump however increased the tariffs by 25 if your order goes over 800. Tariffs are mostly levied on imports but there are cases of tariffs on exports.

This situation could take decades to resolve effectively becoming the new normal. Fill in declarations and other paperwork. Check if theres duty or VAT.

Commercial value 0125. To each trade relation between the country of export and the country of import. Currently a 40 percent import duty rate applies to fresh driedprocessed dates and 25 percent on wheat flour.

The actual duty rate of the item you import may not be what you think it should be as a result of your research. Sometimes you may get scot free if theyre really busy in the holiday season or such but mostly not as they are used to this trick being played on them repeatedly. USA Customs Import and Export Duty Calculator.

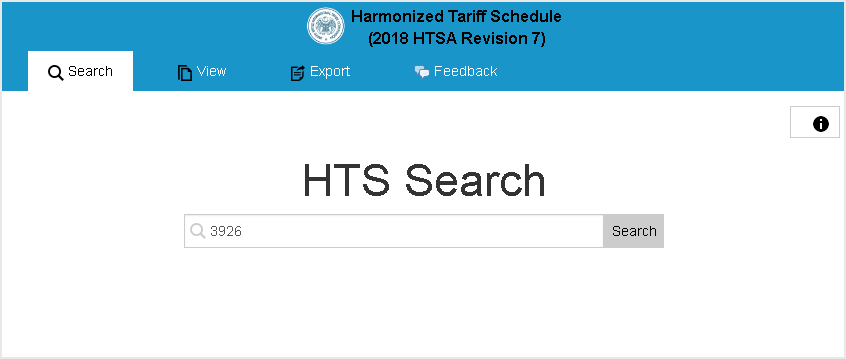

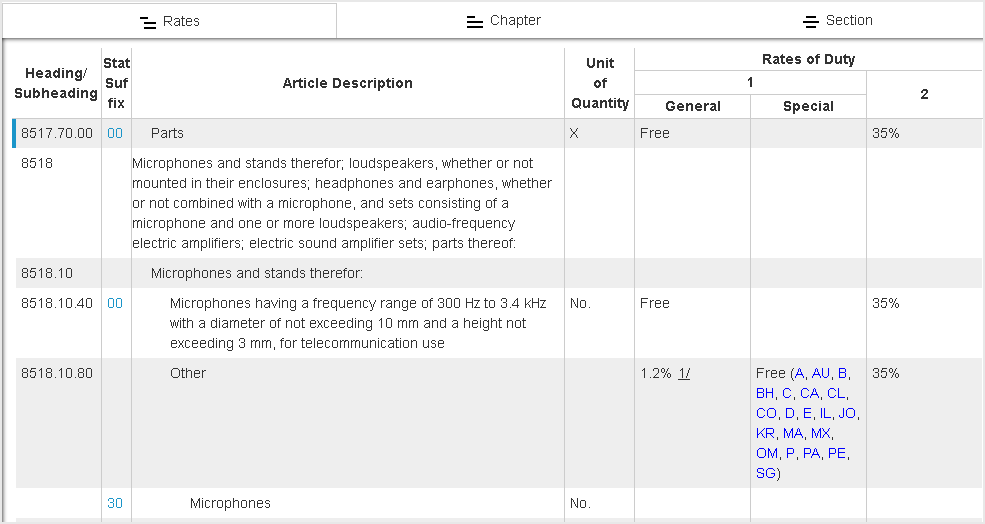

The tariff rate on LED bulb is 39 while importing from China to US. Commercial value 03464 shall not be less than 2622 HMF fee. Commodity codes classify goods for import and export so you can.

VAT on imports is calculated on the declared customs value plus applicable duty and excise tax. The first reduced VAT rate of 15 percent is charged for selected goods such as food. Poultry imports face a mixed tariff.

For example if you are importing Blankets into the US by the ocean with a total commercial value of 3000 then the major customs duty and tax will consist of the following parts. International Trade Commission-Tariff Database is an interactive data base that will enable you to get an approximate idea of the duty rate for a particular product. Importers need to assess if they can.

President Barack Obama introduced AliExpress import tax exemption to 800 which means that you can make bigger orders. Items like books usually have a very low tariff while shoes and clothing often attract some of the highest tariffs. The value of 400 is also high as they allow a max of Rs2000 duty free.

65 of 28000 is 1820. Before importing cloths from China to US.

Importing From China To Usa Customs Duties China Purchasing Agent

Import Export Taxes And Duties In China In 2021 China Briefing News

A Comprehensive Guide For Shipping From China To Usa

Us 20 For Custom Taxes Duties Tariff Vat In Europe Only Tax Free Bonds Tax Free Investing

Us Import Duties Taxes How Much And When Do I Have To Pay For Import Tax Import Dojo

If You Are Involved In Any Trade Business In India Then It Is Important That You Understand The Import Duty India Imp Custom Indian Customs Customs Duties

Import Duties On Non Eu Bicycles Bike Europe

Importing From China To Usa Customs Duties China Purchasing Agent

Amazon Fba Uk Import Tax Custom Duty Vat Explained For Beginners Youtube

Alibaba S Million Jobs In Usa Promise Rescinded

How To Find Hs Codes And Calculate Duties And Taxes Youtube

Duties And Taxes Required To Import To Spain From Outside European Union Spain Order Fulfillment Virtual Address Europe Forwarding Postal Mail

Pin On My Hero Academia Episodes

How To Find Your Product S Commodity Code Tariff Codes Commodity Codes Uk Checker Shippo

How To Save On Vat And Customs Duties When Buying From China From July 2021

How To Find Hs Codes And Calculate Duties And Taxes Youtube

Import Tax From China To Us 2021 Be Less Affected By Trade War

Posting Komentar untuk "Ali Express Us Trade Tarifs Tax Duty"